I asked a billionaire this week what he’d do differently if he could start again at 21… He didn’t say “invest earlier” or “take more risks.”… He said: “I’d take half the salary to work for someone smarter than me. I chased money when I should have been chasing mentors.” I really felt that… When I look back at my twenties, every major leap came from something I learned – not something I earned. The cash from those years is long gone. The lessons built everything I have now. I’ve interviewed hundreds of people for this podcast and the pattern is unmistakable. The ones who optimised for learning in their twenties had tremendous career foundations Your ego will try to convince you that the higher-paying job is the better job. It will whisper about status and titles and what you’ll tell people at dinner parties. Ignore it. A job that pays you more but teaches you less is the most expensive decision you’ll ever make. You just won’t see the bill for another decade.

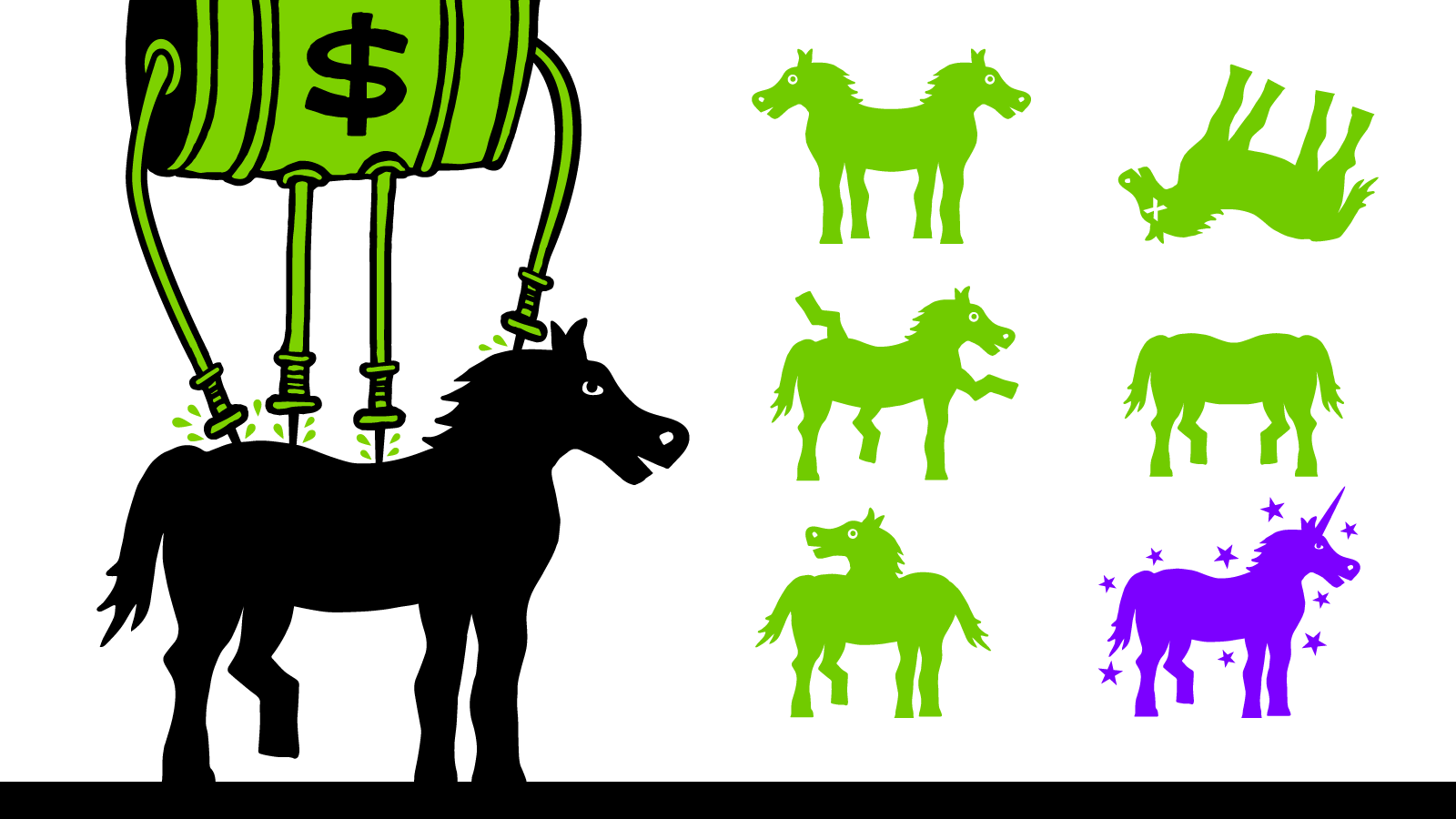

this is probably an unexpected opinion coming from me… entrepreneurship is over-sold and self-awareness is under-sold  The not so popular truth is, most people would be happier with a good salary than a successful startup. But social media continues to push a generation to optimise for lives they don’t actually want. Entrepreneurs like me get a lot of likes and followers when we tell people to quit their jobs and chase their dreams. But here is the context that we nearly always miss

The not so popular truth is, most people would be happier with a good salary than a successful startup. But social media continues to push a generation to optimise for lives they don’t actually want. Entrepreneurs like me get a lot of likes and followers when we tell people to quit their jobs and chase their dreams. But here is the context that we nearly always miss Entrepreneurship can be really really boring – you will have to do things you do not enjoy. You will deal with big, hard, stressful problems, every day – including bank holidays, christmas and any other time off – for years. If you’re lucky enough to be successful, the problems will get bigger, not smaller. You will not have one boss. You will have hundreds – every customer, every investor, every employee. You will answer to them 24/7. You will probably work 3x the hours you do now, have 10x the stress and a tiny probability of significant success. A recent survey found 87.7% of founders deal with at least mental health issues. That’s not a bug. It’s a feature of entrepreneurship. You’ll see your kids less. You’ll probably earn less (for years, maybe forever). You will probably pay yourself last and as little as possible. You’ll struggle to switch off. Forever. Your phone will probably become a prison. And here’s the punchline: If you succeed, it all gets harder. More money = more complexity. More growth = more anxiety. More success = more people depending on you. In life, when you find yourself following someone else’s playbook, you are at risk of winning someone else’s prizes. All I’m saying is be intentional. I’m not AGAINST entrepreneurship, I’m FOR self-awareness. Truth “wealth” is probably

Entrepreneurship can be really really boring – you will have to do things you do not enjoy. You will deal with big, hard, stressful problems, every day – including bank holidays, christmas and any other time off – for years. If you’re lucky enough to be successful, the problems will get bigger, not smaller. You will not have one boss. You will have hundreds – every customer, every investor, every employee. You will answer to them 24/7. You will probably work 3x the hours you do now, have 10x the stress and a tiny probability of significant success. A recent survey found 87.7% of founders deal with at least mental health issues. That’s not a bug. It’s a feature of entrepreneurship. You’ll see your kids less. You’ll probably earn less (for years, maybe forever). You will probably pay yourself last and as little as possible. You’ll struggle to switch off. Forever. Your phone will probably become a prison. And here’s the punchline: If you succeed, it all gets harder. More money = more complexity. More growth = more anxiety. More success = more people depending on you. In life, when you find yourself following someone else’s playbook, you are at risk of winning someone else’s prizes. All I’m saying is be intentional. I’m not AGAINST entrepreneurship, I’m FOR self-awareness. Truth “wealth” is probably

Knowing what game you want to play and why

Knowing what game you want to play and why  Having the courage not to play other people’s games Understanding your real strengths and weaknesses Designing within them, not against them Happiness is not about the structure, the social media post or the story. Happiness is about alignment. Building a life that’s aligned to whoever you are! This does the beg the question, why do I do it? If I’m honest, the answer is probably….I don’t know. It’s probably some blend of lower t trauma, my inability to fit inside normal structures like school and conventional work-places (I was fired a few times), my adhd brain that makes working on something for 14 straight hours feel like 7 minutes and some childhood self-esteem issues. Whatever the reason, this is who I am and what works for me. This is the weird way I make myself happy and fulfilled. To someone that is not me, it would probably feel like torture. And to me, their life would probably feel like torture. And that’s the thing… when you create a life that feels like home to you, it will probably look like hell to tourists.

Having the courage not to play other people’s games Understanding your real strengths and weaknesses Designing within them, not against them Happiness is not about the structure, the social media post or the story. Happiness is about alignment. Building a life that’s aligned to whoever you are! This does the beg the question, why do I do it? If I’m honest, the answer is probably….I don’t know. It’s probably some blend of lower t trauma, my inability to fit inside normal structures like school and conventional work-places (I was fired a few times), my adhd brain that makes working on something for 14 straight hours feel like 7 minutes and some childhood self-esteem issues. Whatever the reason, this is who I am and what works for me. This is the weird way I make myself happy and fulfilled. To someone that is not me, it would probably feel like torture. And to me, their life would probably feel like torture. And that’s the thing… when you create a life that feels like home to you, it will probably look like hell to tourists.

Please know what you are not!

To listen to the full @theartofthebrand_ episode head to the Art of the Brand podcast streaming on all platforms or head to my link in bio

BERKSHIRE HATHAWAY INC.

NEWS RELEASE

Lagos to Tokyo: Global startup lessons from Iyin Aboyeji and Akio Tanaka

The path to building a successful startup is rarely straightforward. Osamuyi noted that even the brilliant founder can have a vastly different outcome in a different market. This is especially important to think about in Nigeria, where the weakening naira is pushing founders to chase foreign currency and “build for the world.” Aboyeji noted that this trend comes with a significant risk. He cautioned against the temptation to scale globally without a deep understanding of the target market

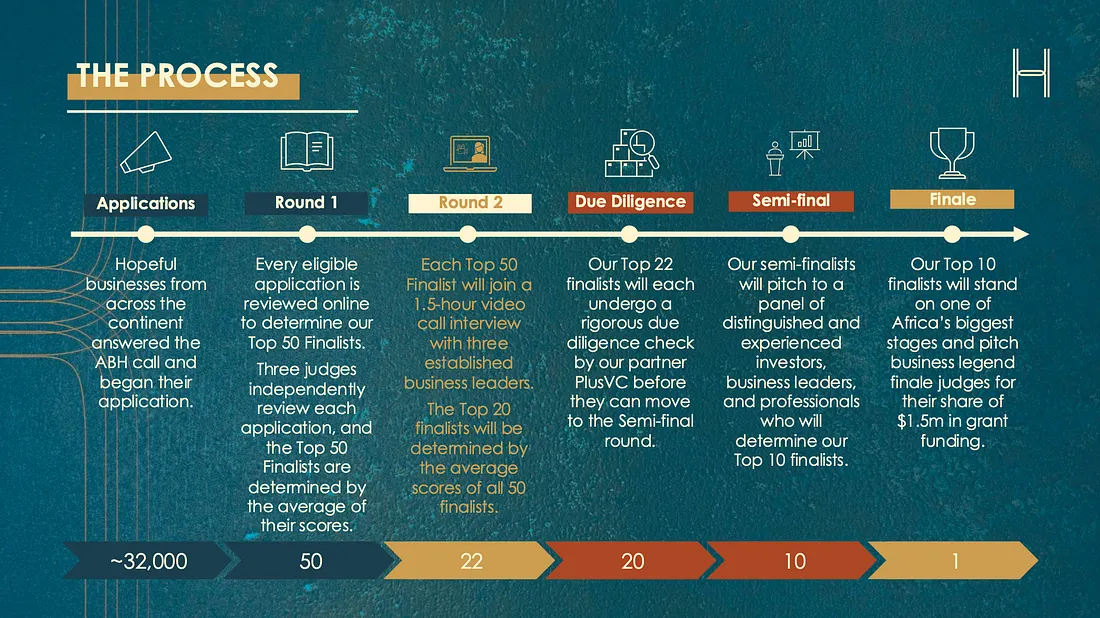

Jack Ma’s ABH rejected us for the next stage but the reason is a little funny

I wasn’t groveling enough for someone that wanted to get to the next stage and I find that very appalling because that’s why we don’t have so many real builders in the ecosystem anymore, just charistmatic thieves. We keep funding smooth talkers and people that tell sweet stories instead of building businesses that have great unit economics and are actually good and doing well. So many ideas that sound good in theory but not in practicality because the founder told a good story and played the “game”.

You’ve probably heard about “first mover advantage”: if you’re the first entrant into a market, you can capture significant market share while competitors scramble to get started. That can work, but moving first is a tactic, not a goal. What really matters is generating cash flows in the future, so being the first mover doesn’t do you any good if someone else comes along and unseats you. It’s much better to be the last mover – that is, to make the last great development in a specific market and enjoy years or even decades of monopoly profits.

Summary: Peter Thiel’s Zero To One

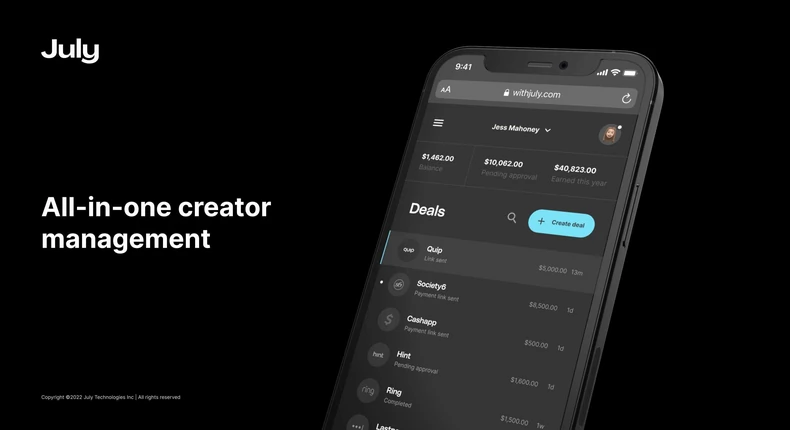

Read the pitch decks that helped 17 creator economy startups raise millions of dollars

Skye, a career-coaching startup, had different decks depending on the type of investor or fund they were pitching to.

“I had two different versions, depending on the fund,” said Jessica Wolf, Skye’s CEO and cofounder. “If I knew a fund was more into pre-seed, all about the founder, I had one deck. But if I knew that they were a numbers person, I would use another one.”

Judgment Is the Decisive Skill

Ultimately, everything else that you do is actually setting you up to apply your judgment. One of the big things that people rail on is CEO pay. For sure there’s crony capitalism that goes on where these CEOs control their boards and the boards give them too much money.

But, there are certain CEOs who definitely earned their keep because their judgment is better.

Naval: And the reason why a lot of the top investors, a lot of the value investors, like if you read Jeremy Grantham, or you read Warren Buffet, or you read up on Michael Burry, these people sound like philosophers, or they are philosophers, or they’re reading a lot of history books or science books.

Why Carnegie Mellon’s condemnation of a professor’s viral tweet is troubling.

Since the death of Elizabeth was a massive news story and the tweet was going viral, the university’s administrators seem to have succumbed to public pressure to sanction Anya in some way out of a desire to defend the university’s reputation. As I’ve described at length before, the tendency of organizations to cave to spontaneously formed social media mobs is a terrible thing for a culture of free speech, and it’s a labor issue, too. There is always the option of trying to wait out the mob, which often dissipates as quickly as it forms.

OUR PROFESSIONAL DECLINE IS COMING (MUCH) SOONER THAN YOU THINK

Here’s how to make the most of it.